Find out when you’re responsible for the deductible – and how to avoid paying it when you’re not at fault.

In Texas, the person who caused the accident usually pays for the damages – but that doesn’t always mean their insurance covers your deductible. If you use your own coverage to get repairs done faster, you might have to pay the deductible upfront, even if you’re not at fault.

So when exactly do you pay, and when can you get that money back? The answer depends on the details of the crash, who’s at fault, and how the insurance companies handle the claim. Understanding the rules now can save you time, stress, and money later.

Understanding Car Insurance Deductibles

A deductible is the amount you agree to pay out of your own pocket before your insurance company picks up the rest of the bill. It applies when you’re filing a claim with your own insurer – whether it’s for a car crash, hail damage, or even theft.

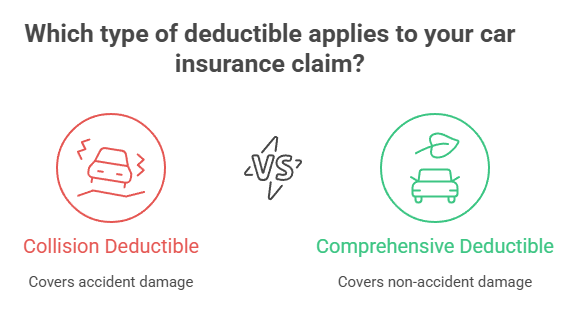

There are two main types of deductibles in auto insurance:

- Collision deductible: Applies when your car is damaged in an accident, whether you hit another vehicle, a pole, or something else.

- Comprehensive deductible: Covers non-collision incidents, like vandalism, a falling tree branch, or a break-in.

Let’s say your collision deductible is $500. If you cause an accident and your repair bill is $3,000, your insurer pays $2,500 after you cover the first $500.

Keep in mind: If the accident wasn’t your fault, and you use your own insurance to get your car fixed quickly, you might still pay your deductible up front. You could get reimbursed later – more on that in a bit.

Texas Is an At-Fault State – What That Means

Texas uses an “at-fault” system for car accidents. That means the driver who caused the crash is responsible for covering the damage – usually through their liability insurance. If the other driver is clearly at fault, their insurance should pay for your repairs, medical bills, and sometimes even your deductible.

But here’s where it gets tricky: fault isn’t always black and white. Texas follows what’s called modified comparative fault, or the 51% rule. If you’re found to be more than 50% at fault, you can’t recover anything from the other driver’s insurance. If you’re 50% or less at fault, you can still get compensated – but your payout is reduced based on your share of the blame.

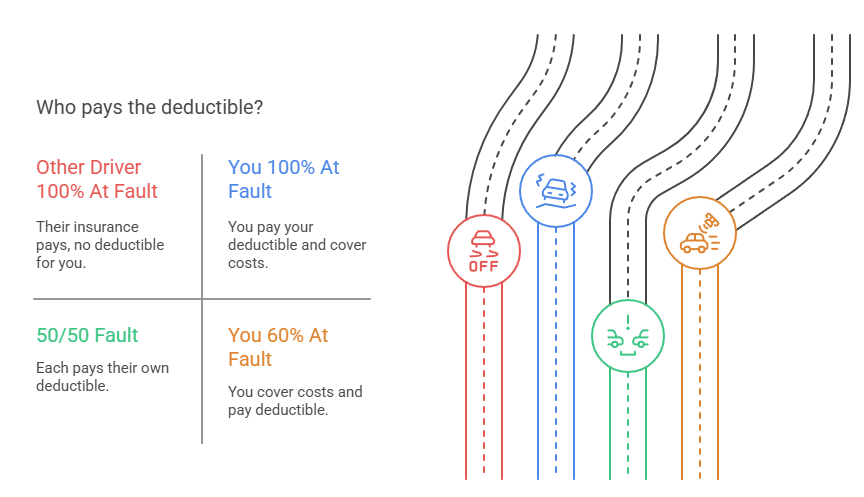

Let’s look at a few common examples:

| Situation | Who’s At Fault | Who Pays the Deductible? |

|---|---|---|

| Other driver runs a red light | 100% other driver | Their insurance pays – no deductible for you |

| You rear-end someone | 100% you | You pay your deductible |

| Both drivers speed and collide | 50/50 split | Each pays their own deductible |

| You’re 60% at fault | You | You cover the cost through your policy and pay the deductible |

This system means fault matters – a lot. And in many cases, your deductible may be tied directly to how clearly that fault is assigned.

Scenarios for Who Pays the Deductible

Knowing who pays the deductible after a car accident in Texas depends on the specific circumstances of the crash. Below are the most common situations drivers face – and how they usually play out.

1. You’re at fault

If you caused the accident, you’ll need to file a claim through your own collision coverage. In this case, you’re responsible for paying your deductible before your insurance pays the rest.

Example: You rear-end another car. Your damage totals $2,000, and your deductible is $750. Your insurance covers $1,250, and you pay the $750 out of pocket.

2. The other driver is at fault

If the other driver is clearly responsible and their insurer accepts liability, they should pay for your damages directly. That means you don’t pay a deductible at all. But this process can take time.

To speed up repairs, many people use their own collision coverage and pay the deductible upfront. Your insurer may later recover the money and refund your deductible through a process called subrogation.

If both drivers are partly at fault, things get more complicated. Texas law allows compensation only if you’re 51% or less at fault. If that’s the case, you may recover a portion of your damages – and possibly part of your deductible.

Example: You’re found 30% at fault, and the other driver is 70%. Your insurer might cover your repairs and try to recover 70% of the costs, including part of your deductible.

4. The other driver is uninsured

If the at-fault driver doesn’t have insurance, you’ll likely need to file a claim under your uninsured motorist (UM) coverage, if you have it. Most UM policies still have a deductible, though it’s often lower.

Without this coverage, you could be left paying for all repairs yourself – and possibly suing the other driver to recover costs.

5. Hit-and-run accidents

If someone hits your vehicle and leaves the scene, you’ll likely file through your own insurance policy. Whether it’s covered under UM or collision depends on the details – but either way, you’ll probably have to pay your deductible up front.

In each of these cases, the rules around deductibles aren’t just legal – they’re also practical. How quickly you want repairs done, how much documentation you have, and the speed of insurance investigations all play a role in what you’ll pay and when.

Subrogation and Getting Reimbursed

Subrogation is the behind-the-scenes process that may help you get your deductible back after a not-at-fault accident. It happens when your insurance company pays for your damages, then seeks repayment from the at-fault driver’s insurer.

If your insurer is successful in recovering the costs, they’ll also request reimbursement for your deductible – and send that money back to you.

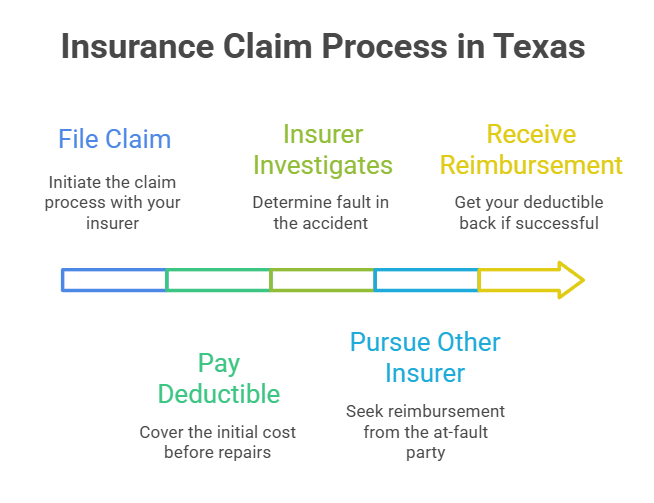

Here’s how it typically works:

- You file a claim with your own insurance to get repairs started quickly.

- You pay your deductible upfront.

- Your insurer investigates and determines the other driver was at fault.

- They pursue the other insurer for reimbursement through subrogation.

- If successful, they send you a check for your deductible.

The process isn’t always fast. Depending on how long it takes the other insurer to respond – or if fault is disputed – reimbursement could take weeks or even months. It’s a good idea to stay in contact with your claims representative and ask for updates if you’re waiting on a deductible refund.

Tips for Dealing With Insurance Companies

Navigating insurance claims after a car accident can be overwhelming – especially when deductibles, repairs, and blame are all in the mix. These tips can help protect your finances and make the process smoother.

1. Document everything

Right after the accident, take photos of the scene, damage to all vehicles, and any visible injuries. Keep a detailed log of who you spoke to, when, and what was said.

2. Get multiple repair estimates

Even if your insurer recommends a shop, you have the right to choose your own. Collect at least two estimates to compare pricing and make sure you’re not being overcharged.

3. Understand your policy

Know what types of coverage you have – collision, comprehensive, uninsured motorist – and what your deductible amounts are. This helps you avoid surprises when it’s time to file a claim.

4. Put important communication in writing

If you speak with an adjuster on the phone, follow up with an email confirming the details. This creates a paper trail if there’s a dispute later on.

5. Ask about reimbursement options

If you’re not at fault but pay your deductible upfront, check with your insurer about their subrogation efforts. Knowing the timeline and process can help you plan financially.

6. Talk to a lawyer if things get complicated

If you’re being unfairly blamed, your claim is denied, or the other driver’s insurer is stalling, legal support can make a big difference. Genthe Law Firm in Dallas helps clients protect their rights and avoid paying when they shouldn’t have to.

FAQs about Paying a Deductible After a Car Accident in Texas

Do I always have to pay my deductible after a car accident?

No. If the other driver is at fault and their insurer accepts liability, you may not have to pay anything. But if you use your own insurance, you’ll likely pay the deductible first – even if you’re not at fault.

Can I get my deductible refunded?

Yes. If your insurer successfully recovers damages from the at-fault driver’s insurer, they may reimburse your deductible through subrogation.

How long does deductible reimbursement take?

It can take several weeks to a few months. The timeline depends on how quickly fault is accepted and how fast the other insurance company responds.

What if both drivers are at fault?

Your responsibility may be split. If you’re 51% or more at fault, you’ll cover your own repairs and deductible. If you’re less than 51% at fault, you may still get partial reimbursement.

Is there a deductible for uninsured motorist claims in Texas?

Yes. If you use your uninsured or underinsured motorist coverage, there’s usually a deductible – but it’s often lower than your collision deductible.

What happens if I don’t have collision or uninsured motorist coverage?

You may have to pay all repair costs out of pocket unless the other driver’s insurance covers it.

Can I sue the at-fault driver to recover my deductible?

Yes, though your insurance company may already be doing that through subrogation. If they don’t, small claims court may be an option.

It might. Even if you’re not at fault, using your own coverage can sometimes lead to a rate increase. It depends on your insurer’s policies and your claims history.

Should I hire a lawyer after a car accident?

If liability is unclear, you’re facing delays, or the insurance company denies your claim, a lawyer can help protect your interests. Genthe Law Firm helps drivers across Texas deal with these issues every day.

Don’t Let Insurance Confusion Cost You – Call Genthe Law Firm Today

Getting stuck with a deductible after an accident that wasn’t your fault can feel unfair – and in many cases, it is. Whether you’re dealing with a slow insurance process, a denied claim, or questions about fault, Genthe Law Firm is here to help. Our team works with drivers across Texas to make sure insurance companies do their job and that you’re not left paying more than you should.

If you’ve been in a car accident and need legal guidance, call Genthe Law Firm in Dallas at 214-957-0898 for a free consultation.

Page Contents

- Find out when you’re responsible for the deductible – and how to avoid paying it when you’re not at fault.

- Understanding Car Insurance Deductibles

- Texas Is an At-Fault State – What That Means

- Scenarios for Who Pays the Deductible

- Subrogation and Getting Reimbursed

- Tips for Dealing With Insurance Companies

- FAQs about Paying a Deductible After a Car Accident in Texas

- Do I always have to pay my deductible after a car accident?

- Can I get my deductible refunded?

- How long does deductible reimbursement take?

- What if both drivers are at fault?

- Is there a deductible for uninsured motorist claims in Texas?

- What happens if I don’t have collision or uninsured motorist coverage?

- Can I sue the at-fault driver to recover my deductible?

- Will filing a claim increase my insurance premium?

- Should I hire a lawyer after a car accident?

- Don’t Let Insurance Confusion Cost You – Call Genthe Law Firm Today